KEY HIGHLIGHTS

- Singaporeans will receive up to S$850 in GST Voucher cash support in 2026.

- The payout directly offsets higher daily costs caused by inflation and the 9% GST.

- For many households, this cash relief helps cover essentials like food, utilities, transport, and healthcare.

That’s exactly why the S$850 GST Voucher (GSTV) Cash payout in 2026 matters. This isn’t symbolic support. It’s real money meant to soften the impact of higher prices on everyday essentials, especially for lower- and middle-income Singaporeans.

The GST Voucher is part of the Government’s broader cost-of-living support framework. Instead of controlling prices or limiting spending choices, it puts cash directly into your hands — so you decide where the relief is most needed.

Why Cost of Living Pressures Are Still High in Singapore

Inflation in Singapore hasn’t disappeared. Even as global prices stabilise in some areas, households are still dealing with knock-on effects from earlier spikes in energy, food, and labour costs. As a country that imports most of what it consumes, higher global prices translate quickly into local expenses.

The staged GST increase — 8% in 2023 and 9% from 2024 onwards — was necessary for long-term public finances, especially healthcare spending. But in the short term, it raised the cost of daily consumption, from groceries to phone plans.

| Cost Pressure Area | What Singaporeans Are Feeling | How GST Voucher Helps |

|---|---|---|

| Groceries & food | Higher prices at supermarkets, wet markets, hawker centres | Cash offsets GST embedded in food prices |

| Utilities | Electricity and water bills fluctuate with global energy costs | Helps pay monthly household bills |

| Transport | Fare adjustments and fuel-related costs | Reduces commuting and mobility burden |

| Healthcare | Rising consultation and medication costs | Covers out-of-pocket medical expenses |

| Digital services | GST applies to subscriptions and online services | Eases recurring monthly charges |

What Exactly Is the S$850 GST Voucher in 2026?

The S$850 GST Voucher Cash payout is part of the permanent GST Voucher Scheme. It is targeted support for Singapore Citizens with lower incomes and modest property ownership.

The aim is straightforward: help households cope with the higher cost of living without complicated claims or restrictions. Unlike rebates tied to specific bills, this is flexible cash that can be used immediately.

Key goals of the GST Voucher include supporting retirees, helping working families manage monthly expenses, and reducing the regressive impact of indirect taxes like GST.

Where the S$850 Makes the Biggest Difference

Groceries and Daily Food Spending

Food costs are often the first thing families notice going up. Rice, cooking oil, vegetables, meat, and even basic meals outside have all become more expensive.

For many households, S$850 can comfortably cover one to two months of groceries, especially for smaller families or seniors living alone. That’s real breathing space when prices spike.

Utilities and Household Bills

Electricity, water, and gas bills don’t feel optional — you have to pay them. When tariffs go up, monthly budgets feel tighter fast.

The GST Voucher helps households manage utility bills, internet plans, mobile subscriptions, and even conservancy charges without tapping into emergency savings.

Transport and Commuting Costs

Public transport remains affordable, but fare adjustments and higher operating costs still add up over time. For workers commuting daily or seniors relying on buses and MRT, the GST Voucher helps absorb these recurring expenses.

Healthcare and Insurance-Related Expenses

Healthcare inflation is a quiet but steady pressure. Clinic visits, medications, and allied health services all cost more over time.

The S$850 cash payout gives families flexibility to cover medical co-payments, screenings, or eldercare needs — especially useful when MediSave alone isn’t enough.

Why Cash Support Works Better Than Price Controls

Direct cash transfers are efficient and practical. They don’t distort markets or create shortages. Instead, they let households decide what matters most — food, bills, healthcare, or savings.

Because the GST Voucher is means-tested, support is focused on those who feel inflation the hardest, while keeping public finances sustainable.

Who Is Most Likely to Receive the Full S$850?

You’re more likely to qualify for the higher payout if you are a Singapore Citizen, earn below the income threshold, own no more than one property, and live in an HDB flat or lower-value residence.

This targeting ensures the support goes to households most exposed to rising prices and GST-related costs.

Why Payment Timing Matters

The GST Voucher is paid through PayNow (NRIC-linked), bank crediting, or cash collection for those without bank access. This means households receive support when they actually need it — not months later through rebates.

Liquidity matters when bills are due now, not later.

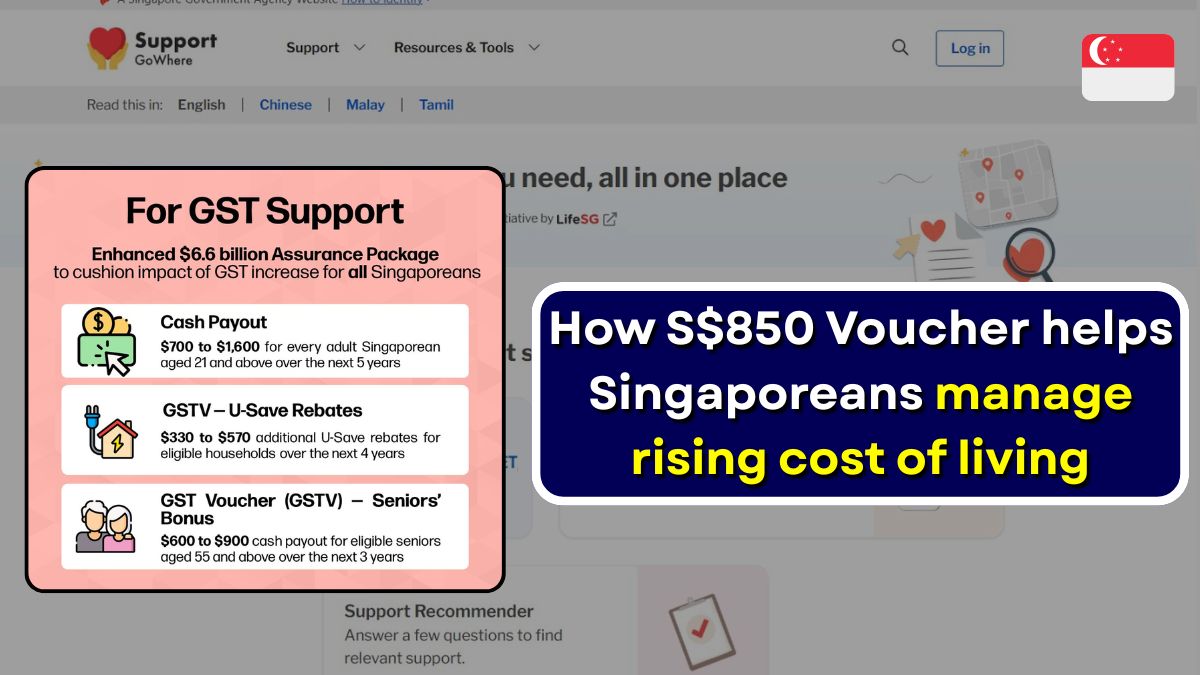

The Bigger Picture: Long-Term Cost-of-Living Support

The GST Voucher doesn’t work alone. It complements other schemes like U-Save rebates, MediSave top-ups, and Assurance Package payouts. Together, they form a layered safety net that helps households stay financially stable even as prices rise.

Search interest around cost of living support in Singapore, GST Voucher payout 2026, and inflation relief keeps growing — a clear sign that practical financial help remains top of mind for many residents.

Frequently Asked Questions

How does the S$850 GST Voucher help with inflation?

It provides direct cash support that offsets higher prices caused by inflation and the 9% GST, especially for essential daily expenses.

Is the S$850 GST Voucher taxable income?

No. GST Voucher payouts are not taxable and do not affect your income tax.

Can the GST Voucher be used for any purpose?

Yes. The cash is unrestricted and can be used for groceries, bills, healthcare, transport, or savings.